The acquisition is one of the major growth drivers in engineering services. According to my research about one-third of the growth of leading engineering service providers is because of acquisitions.

Few reasons why acquisition is more important in engineering services compare to say IT services or BPO.

- Lack of large deals in engineering services

- Technical expertise is valued more in core products and services unlike support functions of SG&A

- Organically very difficult to grow in new areas in engineering services

- Geography footprint of technical experts is difficult to establish and scale

- Sometimes the only way to get customer access is to acquire one of the existing engineering service providers

- Niche expert talent is difficult to find

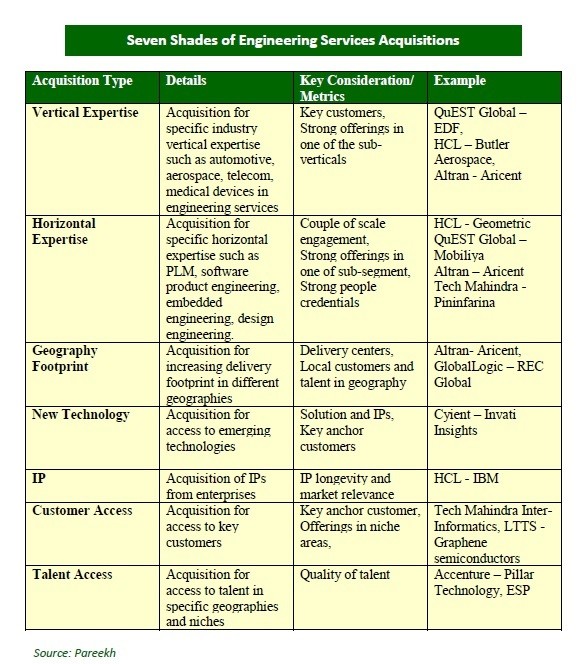

However, all acquisitions are not the same. There are seven types of acquisitions I see in engineering services:

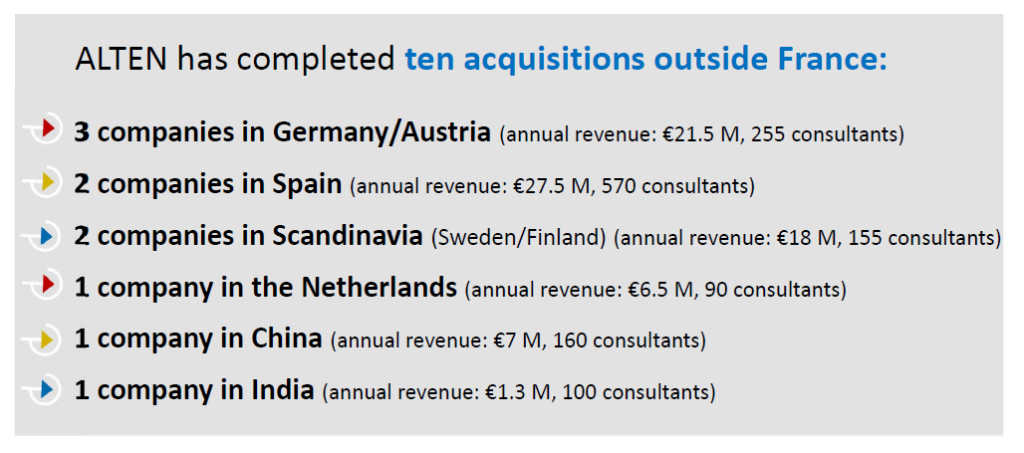

Acquisitions are not only relevant for small firms or mid-tiers to get scale, but even leaders will also need acquisitions for growth and remain relevant. A case in point is of ALTEN, number two player globally by revenue in engineering services. ALTEN added ten companies in the last year.

Source: Alten

Bottom line: The long tail of engineering service providers will provide acquisition pipeline for many years. By some estimates, there are 50,000 engineering service providers less than $10 million. Most of these engineering service providers are founded by ex-employees of enterprises, who are technical experts and know their target customers. But they don’t scale up. All these small service providers will integrate with medium and large service providers. And we may witness the emergence of $5 billion + engineering service providers soon.