I called out ITC Infotech as a best-kept secret in my earlier post, and some people asked me to elaborate on that. Let me try.

First, why is it a secret?

It is easy. ITC Infotech is a mid-tier IT and engineering service provider which is not publicly listed. So, we don’t get to know its financial and business details every quarter. It is part of the ITC Group and the first time ITC called out ITC Infotech’s financial performance in its quarterly results last week. Then the secret is out, and we came to know these details.

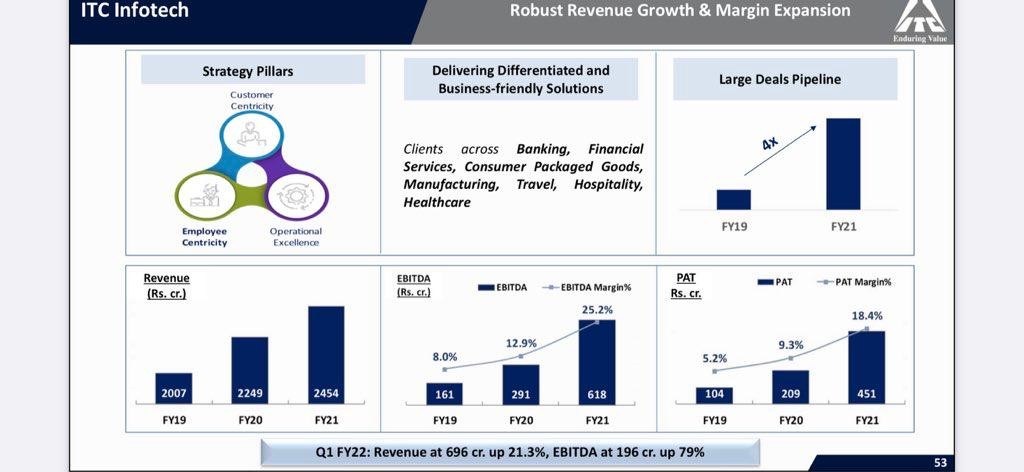

Exhibit 1: ITC Infotech Financial Performance FY 19-FY 21

Source: ITC

Now, why am I calling this out a best-kept secret?

It is because of the extraordinary performance of ITC Infotech in FY 21.

If we say FY21 was a tough year, it will be an understatement. According to NASSCOM, Indian IT Industry grew only by 2.3% in FY 21, and many companies showed revenue decline. In this context, if a service provider is achieving 9.1% YoY growth and 25.2% EBITDA in FY21, it is hitting the ball out of the park.

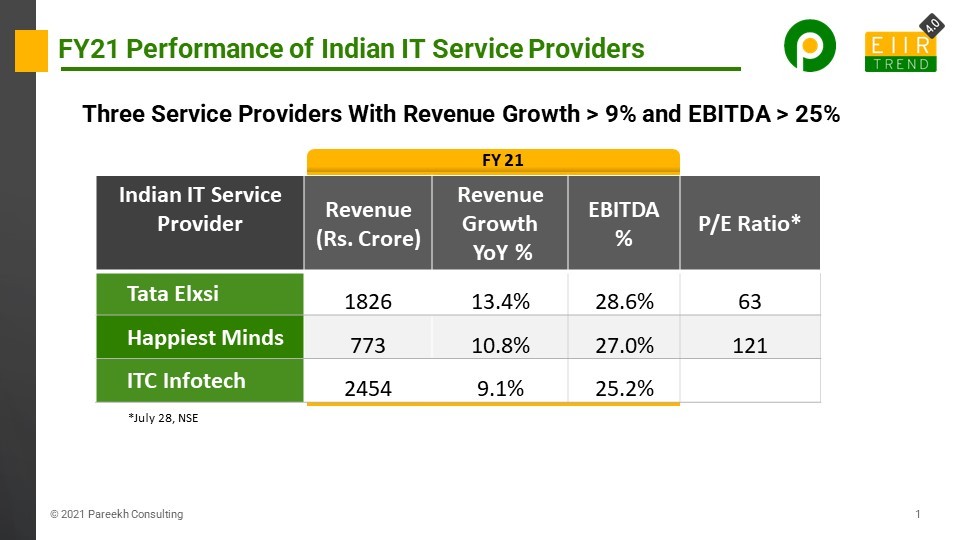

Let’s compare these numbers with the industry. How many Indian IT service providers (any tier) do we know which have revenue growth over 9% and EBITDA over 25% in FY 21? I researched and could find only three such service providers in India, as shown in the below exhibit.

Exhibit 2: Three Indian IT Service Providers With Revenue Growth >9% and EBITDA > 25%

Source: EIIRTrend, Company Reports

It is tough to grow revenue and even tougher to achieve a high margin. A service provider which is able to achieve both is extraordinary, and investors reward such service providers with a high P/E ratio, as shown in the above exhibit.

ITC Infotech is not listed, but if ITC Infotech would have been listed, it may not be crazy to say its stock would have been on fire and in the similar PE range as the other two service providers, which is way above the Indian IT industry P/E average.

I believe performance in downturns is the biggest test for any firm’s strategy and execution.

But is the performance sustainable?

The other question some people were asking is this a one-year wonder, or is the performance sustainable?

With the usual caveat that prediction is a dangerous business, especially about the future, I think ITC Infotech’s performance is sustainable. If we look at exhibit 1, FY 20 numbers were equally good. The margin and revenue uplift are credible & creditable because it appears to have been going on for two years.

In my opinion, it started with the leadership change in ITC Infotech two years back (Feb 2019) and correspondingly strategy refresh of focusing on few areas of their strength in the domain, services, and technology with a differentiated business model. It appears they follow tenets of Outsourcing 4.0 (Read here), focusing on the domain, de-risking, and digital.

However beautiful the strategy, you should occasionally look at the results – Winston Churchill.

The last two years’ results validate ITC Infotech’s strategy and give the confidence of multi-year sustainable performance.

Bottom Line: So, If a service provider is showing extraordinary performance in one of the toughest years for the Indian IT industry and we don’t know about it, isn’t it a best-kept secret, especially when it looks that performance is sustainable.

PS: There may be some other service providers which have performed in that zone and are not on my radar. In that case let me know. Investors are always looking for high performers and best kept secrets =)