Why some engineering service providers scale and some don’t? Why some service providers scale for some time and then struggle? Will service providers continue to grow further? How long can they grow, and what could be their growth curve? What changes service providers need to do for their next phase of growth?

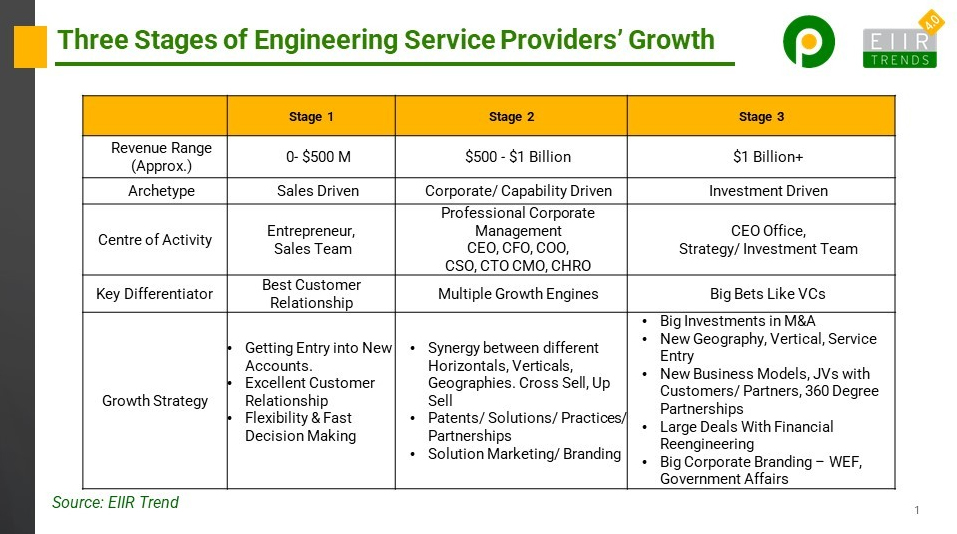

There are many factors, including capabilities, tailwinds, etc., which are responsible, but there is one factor that I would like to highlight is the alignment of the growth strategy with the organization size. In my engineering research, I found there are three broad stages of growth of pure-play engineering service providers, and each has a distinct archetype, center of activity, differentiators, and growth strategy.

- Stage 1: The first stage is mainly entrepreneurial and sales-driven. The center of activity is the entrepreneur and its sales leaders. Things happen fast here. Clients like them for their flexibility and fast decision-making compared to bigger service providers. Here the focus is more on sales than on solutions or marketing.

As service providers in stage one scale, their advantages slowly disappear. This archetype starts to struggle around $400 – 500 Million in revenue. That’s the time it needs to transform to the stage two.

- Stage 2: In the second stage, typically entrepreneur takes a back seat, and the organization is transformed into a corporate-driven structure with strong and effective corporate leaders to manage and plan growth. Here the center of activity is corporate leaders such as COO, CSO, CTO, CFO, CMO, CHRO, apart from the CEO. The focus is more on capability, solutions, and branding in order to develop multiple growth engines. Focus on identifying and developing solutions, filing patents, cross-vertical synergies, account growth with cross-selling and up-selling. One significant difference from stage one is focusing on branding and marketing.

Stage two service providers are able to show good predictable growth for few years, but as they start reaching billion-dollar in revenue, they start competing more and more with bigger players. To beat bigger players, they need to transform to the stage three.

- Stage 3: This stage is investment-led. Think like a VC and take a few investment bets, including scaled acquisitions, getting into new areas, geographies, among others. Here the center of activity is CEO’s office and strategy team, which proactively looks for structuring large deals with aggressive terms, different business models such as JVs, 360-degree partnerships, and other non-linear revenue growth opportunities such as buying assets including captives, product IPs, etc.

This stage requires additional investment to take bets, and that’s where many service providers’ shareholders face the dilemma of cashing out or going to the next stage. Also, sometimes bets are not successful that derails service providers from the growth curve in stage three.

Some service providers don’t radically change or transform and are able to hang around or marginally grow for some more time. Most of such service providers become good acquisition targets. And if we look at some of the service providers that have been acquired, we will find most of them were struggling to go to stage 2 or stage 3. Also, occasionally we can find service providers in stage three as acquisition targets whose bets were not successful and growth got derailed.

Bottom Line: What took service providers here may not be able to take them to the next level. Many organizations will need to transform and change their strategy for their next phase of growth. The good news is that for engineering services, potential market size is not a constraint. If service providers are able to transform themselves, they have good room for growth!