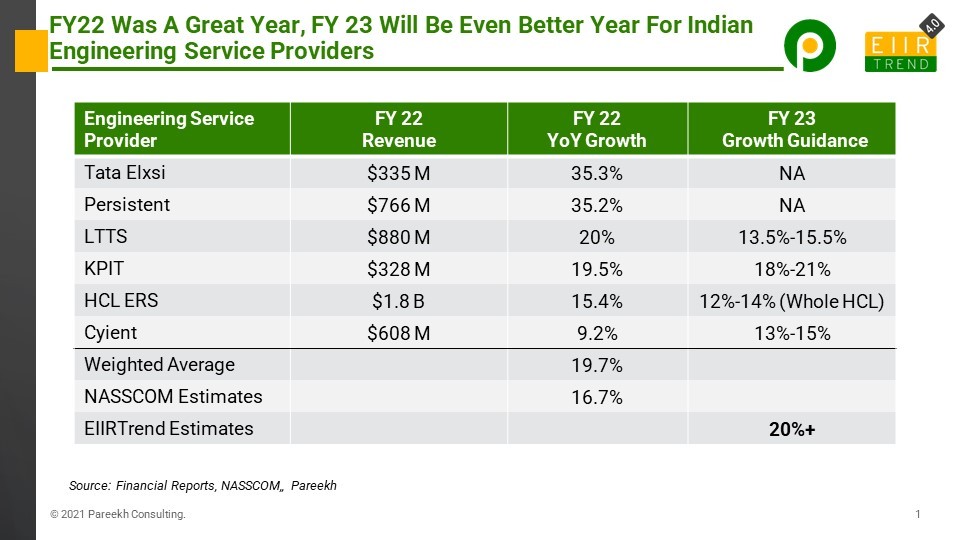

FY 22 Results of Top Six Indian Engineering Service Providers (who declare engineering service revenue in financial results) are out. FY 22 has been a landmark year for engineering services.

The YoY growth among these six engineering service providers varies between 9%-36%. The weighted average growth rate is 19.7%. The growth rate of many other large Indian engineering service providers who don’t declare their engineering revenue is in a similar range.

NASSCOM estimated the FY 22 growth rate of the Indian engineering sector as 16.7% (Strategic Review Released in February 22). The fact that leading service providers have grown more than that is an encouraging sign.

Will FY 23 be a better year than FY22 for leading Indian engineering service providers?

I think so. Some service providers have given FY23 growth guidance from 12% to 21% range, but I think this is conservative, and for this cohort, we will end up 20%+. Four reasons for this optimism

- Track record of conservative guidance at the beginning of the year. Many service providers provide conservative guidance at the beginning of the year and raise it gradually when they have more visibility and confidence. Most of them prefer to under promise and over deliver instead of over promise and under deliver.

- Large deals, orders won, and deal pipeline: In last week, only three big deals were announced by engineering service providers. If the trend of the large deal continues, then 20% growth will not be difficult. This upswing trend is further supported by orders won and deal pipeline, all at an all-time high.

- All sectors are growing: Earlier, few sectors were growing, but now growth is broad-based, and all sectors are growing. Most sectors and geographies are expected to grow double-digit. The aerospace sector has been in decline for the last two years, but we saw signs of growth early this year. (Read here). A big $100 Million deal in aerospace engineering is testimony to the growth potential in this sector.

- Inorganic pursuits: Indian engineering service providers are becoming bold and ambitious in their inorganic pursuits, be it buying another service provider or customer captive or carve-out. A couple of big inorganic deals were announced last week by Indian engineering service providers. If this trend continues, then this will be a contributor to the increased growth rate as well.

Bottom Line: There is a lot of talk about whether the inflection point has been reached in engineering services and has pandemic become an accelerator for engineering service outsourcing the way the GFC in 2008 became an accelerator for IT outsourcing. While we can debate with points and counterpoints (Read my points here), the real proof is in the result only. If a cohort of leading Indian engineering service providers can grow by 20% for two consecutive years, then it will be safe to claim that the inflection point has reached for the industry and the slope of the engineering services outsourcing growth curve has changed for good. I am an optimist!