There was news about layoffs in Automation Anywhere, which started speculation of layoffs at other RPA unicorns also. Then there was news about layoffs in other engineering unicorn Magic Leap. Even Zoox, an autonomous vehicle unicorn, is for sale as per news reports.

What’s common in these tech unicorns? They are not profitable yet. With funding becoming scarce, they will have to look for layoffs and other cost optimization measures. How much will they need to layoffs, and what are other cost optimization levers?

Most of the tech unicorns are private firms, and hence we don’t have access to their detailed financials. Luckily one RPA unicorn, Blue Prism, is a public company. We will look at its last available yearly financials to understand the situation.

Blue Prism numbers

- Blue Prism raised funding of £100 million in January 2019. By the end of FY 19 (Oct 2019)

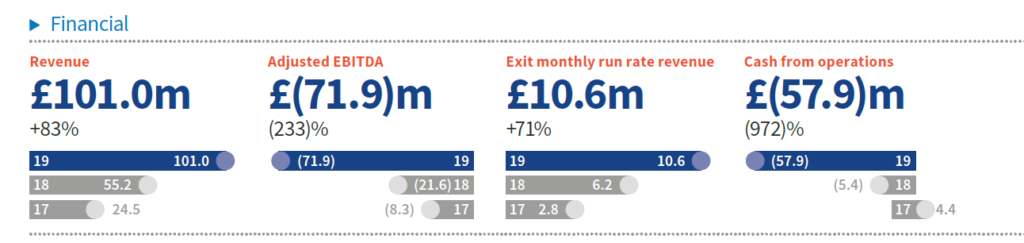

- In FY 19, Blue Prism made a loss of about £72 million on revenue of £101 million. The negative cash flow in FY 19 was about £58 million.

- This negative cash flow was supported by cash reserves, including funding in 2019.

- Blue Prism had cash of £74 million at the end of FY 19.

See Below Financials

Scenarios for FY 20 revenue. Two extremes

- Revenue of £180 million (about 80% growth similar to growth in FY 19)

- Revenue of £101 million (similar to FY 19 revenue)

The first scenario should make Blue Prism profitable, assuming the same expenditure or near profitability with some increase in expenditure. The second scenario will finish all cash in hand for Blue Prism.

The reality will be somewhere in the middle. Being prudent, Blue Prism might plan to have cash in hand for a few years of operations.

- Assume Blue Prism will like to have cash in hand for three years, so they might like to restrict loss to about £25 million/ year.

- For £25 million/ year loss the cost structure needs to be down by £45 million/ year

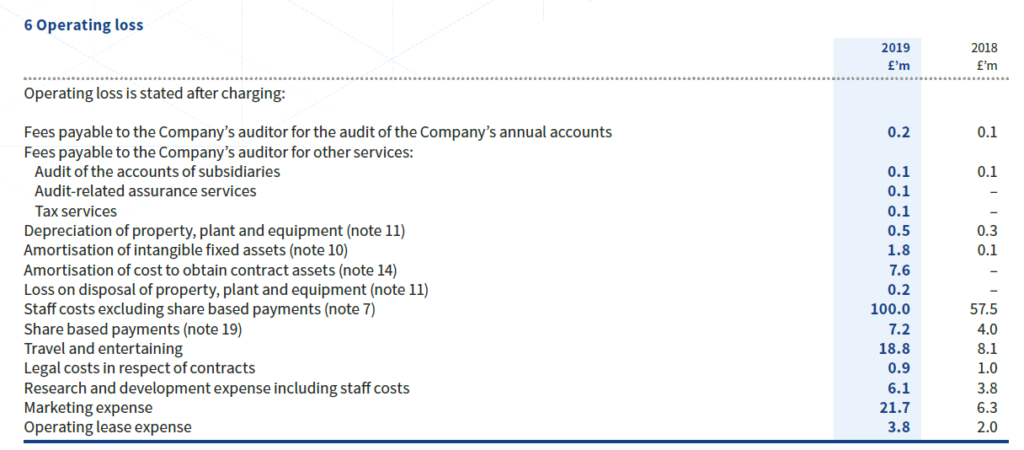

What are levers of reducing cost base by £45 million/ year?

There are three major levers

- Marketing spend (£22 million/ year)

- Travel and entertainment (£19 million/ year)

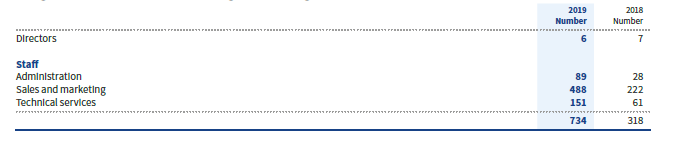

- Sales and Marketing people (Approx. 2/3 of people expense, i.e., £67 million/ year)

The total expense of the above three levers is £108 million/ year from below exhibits

Scenarios of cost reduction of £45 million/ year

- 40% reduction in £108 million/ year could mean saving of approx. £45 million/ year.

- If Marketing and Travel and entertainment spend is reduced by 75%, then Sales and Marketing cost reduction required is about 25% for £45 million/ year

This is a simplistic view, and detailed analysis will bring more scenarios of the combination of different levers.

Bottom Line: Three major cost optimization levers are Marketing spend, Travel & Entertainment spend, and Sales and Marketing people spend. While this is specific to one RPA firm, the lessons are applicable to other RPA firms and larger tech unicorn market of unprofitable firms.