A week back, there was news about the closing down of R&D or captive center of a semiconductor company and the possibility of that work shifting to India. This news led me to think about whether there can be more such cases (i.e., the movement of R&D centers from China to India).

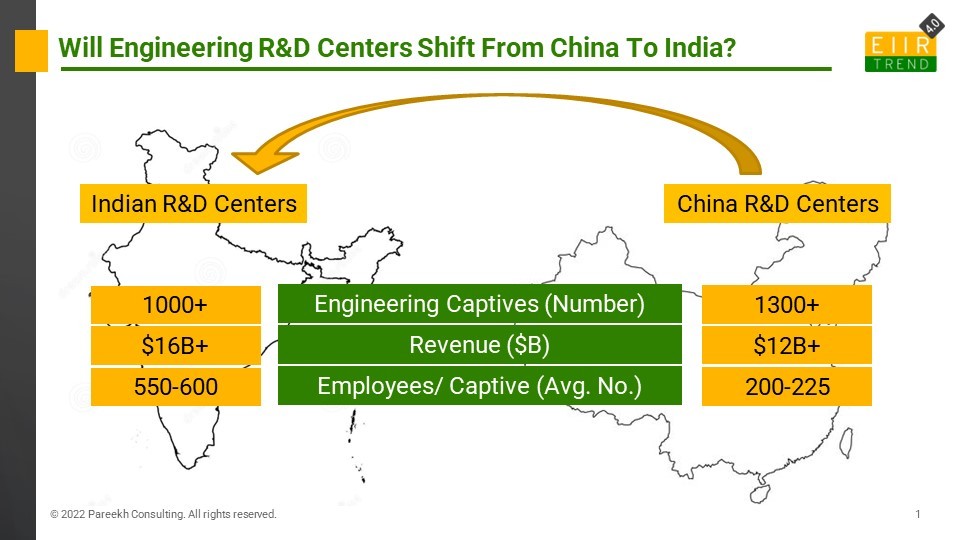

To analyze this first look at the R&D center landscape in China. There are about 1300+ R&D centers in China.

Why did enterprises open R&D centers in China?

Three reasons.

- Tied to Manufacturing: As China had become the manufacturing hub, and engineering is often linked to manufacturing, China had a large number of engineering captive centers, even more than India.

- Tied to Local Market: Many R&D centers were tied to developing or customizing/ value engineering products for the local Chinese market

- The Asia Pacific or Emerging Market R&D Centers: Some enterprises use China centers for either emerging market product development or product development across Asia. For example, Tesla has R&D centers in US, Germany, and China. Most likely, they will use the China center to design and produce a $25K car for emerging markets.

Why will any R&D center shift?

There could be two reasons.

- Subscale Centers: The major hypothesis in a captive shift (buyout or relocation) is the economic viability of a subscale captive, which has less than 500 people. It makes a good economic business case for enterprises to look for exit options for these subscale captives. The interesting part is that though China has more engineering captive centers, its overall engineering captive pie is less than that of India. And guess what? China has more number of subscale captives.

- Shifting of Strategic Priorities: Earlier, China was the undisputed manufacturing capital of the world, and almost every big firm had a big manufacturing presence in China. After pandemic supply chain disruption and geopolitics events, enterprise views on manufacturing in China are diverging. Enterprises that are betting on the local China market are doubling down on China. For example, many automotive enterprises which want to capture China market are increasing their R&D and manufacturing footprints in China. The other set of manufacturers, which are not dominant players in the local China market but use China as a global manufacturing hub, are rethinking their China manufacturing strategy. They are going with the China+1 or China +2 strategy. Geopolitics is also playing a role. Many countries, including India, are very aggressive in building local manufacturing ecosystems on the strength of their local markets. For these firms (who consider China for exports manufacturing), China R&D centers act more as the Asia Pacific or Emerging Market R&D center and might not be the strategic priority now and thus will be open for relocating them.

Why India for R&D center relocation?

Three reasons.

- Established R&D Presence: Almost all major enterprises have R&D centers in India. Instead of building R&D centers in new locations, it makes sense to scale existing R&D centers in India with work from other regions, including China.

- Talent at scale: No other region can offer engineering talent at scale and attractive price points as India can. So if new locations are searched for R&D centers, Indian cities will be at the top of the list.

- Ecosystem: Already, there is a big engineering ecosystem in India with 1000+ ER&D centers and a scaled delivery presence of both Indian and Global engineering service providers. India has the world’s third biggest startup ecosystem, and the manufacturing ecosystem is also improving. So ecosystem advantage is also with India now.

Manufacturing Shift vs. R&D Shift

We talked about manufacturing shifting from China to India because of the China +1 or China +2 strategy and localization initiatives. There is some progress, but not on the scale it was expected. Partly because it is difficult to shift production in a short time and let go of invested CAPEX. On the other hand, R&D centers are easy to shift with mostly people movement.

Bottom line: This will be an interesting trend to watch. As we anticipate a recession, enterprises will be more inclined to relook at their operational footprints, especially subscale captives and ones that are not strategically important. Can this trend go in India’s favor? Well, engineering GIC activity is on an upswing in India, and this could be another tailwind.