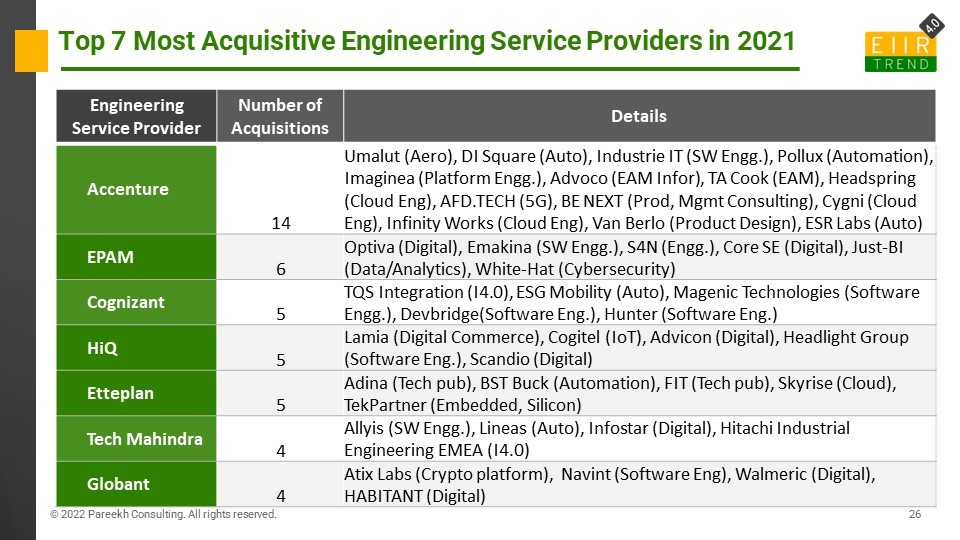

There were more than 80 acquisitions in engineering services in 2021 tracked by EIIRTrend. (Refer Live tracking of Engineering Service Provider M&As here on EIIRTrend platform).

And more than 50% of those acquisitions are by these seven engineering service providers: Accenture, EPAM, Cognizant, HiQ, Etteplan, Tech Mahindra, and Globant.

The acquisition is one of the major growth drivers in engineering services. For some engineering service providers, more than 50% growth is because of acquisitions.

A few reasons why acquisitions are more important in engineering services compared to, say, IT services or BPO are discussed below:

- Lack of large deals in engineering services

- Technical expertise is valued more in core products and services

- Organically very difficult to grow in new areas in engineering services

- The geography footprint of technical experts is difficult to establish and scale

- Sometimes the only way to get customer access is to acquire one of the existing engineering service providers

- Niche expert talent is difficult to find

However, all acquisitions are not the same. There are seven types of acquisitions I see in engineering services:

- Vertical Expertise: Acquisition for specific industry vertical expertise such as automotive, aerospace, telecom, medical devices in engineering services. Cognizant acquisition of ESG Mobility is an example of acquiring automotive expertise.

- Horizontal Expertise: Acquisition for specific horizontal expertise such as Industry 4.0, industrial automation, PLM, software product engineering, embedded engineering, silicon engineering, design engineering. Accenture acquisition of Pollux is an example of acquiring industrial automation expertise.

- Geography Footprint: Acquisition for increasing delivery footprint in different geographies. Alten’s acquisition of Expert Global Solution is an example of augmenting delivery capability in India.

- New Technology: Acquisition for access to emerging technologies. Globant’s acquisition of Atix Labs is an example of acquiring capability in crypto engineering.

- IP: Acquisition of IPs from enterprises. HiQ’s acquisition of IoT specialist Cogitel which has an IoT platform Thelio with licenses is an example of IP-driven acquisition. In past years acquisition of IBM IPs by HCL, Persistent, Wipro, Tech Mahindra were good examples of IP-driven acquisitions.

- Customer Access: Acquisition for access to key customers. Tech Mahindra’s acquisition of Hitachi Industrial Engineering EMEA is a good example of customer access.

- Talent Access: Acquisition for access to talent in specific geographies and niches. The majority of Accenture’s acquisitions in Industry X are acquisitions for talent in specific geographies and niches.

All engineering services acquisitions show one or more of the above shades. Some acquisitions have multiple shades as Cognizant’s ESG Mobility which augmented automotive vertical capability, provided delivery capability in Germany and China, and also opened customer access to many top auto OEMs

Acquisitions are not only relevant for small firms or mid-tiers to get scale, but even leaders will also need acquisitions for growth and remain relevant. Acquisitions are best for new entrants, especially IT MNCs, which are entering into the engineering service space to build and scale capabilities. The long tail of engineering service providers will provide a steady acquisition pipeline for many years.

Bottom line: Acquisitions will remain a dominant strategy for new player entry, building scale, and acquiring capabilities in engineering. If the start of 2022 is any indication, I think we will see more acquisitions in 2022 than in 2021.