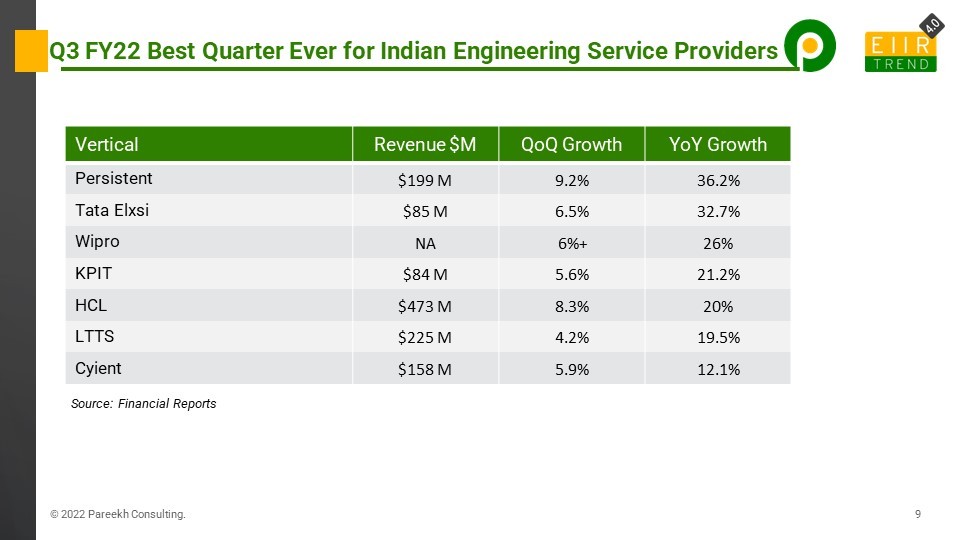

I have been tracking the engineering service market for the last eight years, and I haven’t seen a quarter like this where every engineering service provider, broad-based or pureplay, shows these growth numbers. I think Q3 FY22 is the best quarter ever for Indian ESPs.

Engineering services have a good outsourcing potential, but very little is outsourced to engineering service providers. Only about 5% of the global R&D spend is outsourced to engineering service providers, and only 1% is offshored to India.

We all in the engineering services ecosystem have been waiting for an inflection point for a long. So has the inflection point been reached?

By inflection point, I mean the step-change in the slope of the growth curve of engineering services in India. Well, coming quarters will determine whether the slope has changed for good or not.

I am an optimist and confident that this decade will be the decade of engineering services and the best days for engineering services are ahead. Three main reasons for this optimism:

- Rethinking Assumptions: Engineering is core work for enterprises, and there are a lot of assumptions that it can’t be outsourced, and even if outsourced, it can’t be offshored at scale. That’s the reason European service providers have a larger share because of onshore presence. But this pandemic forced enterprises to relook at these assumptions. Most work is being done virtually, so location constraint is not as big as was once believed. This is driving enterprises to rethink their engineering operating model, and there is no better place than India, which can provide engineering talent at scale and at the right price points.

- Digital: Engineering is the foundation for digital transformation (Read here). Every enterprise is going thru digital transformation to embrace virtualization and also because of competitive pressures from digital natives. Consequently, digital engineering is on steroids (Read here)

- Cost Pressure: The cost was never a dominant reason for engineering outsourcing, but that is changing now. Enterprises exist because of their competitive edge in developing products, and for strategic reasons, they don’t cut costs here as much as they are willing to do in support functions. Every industry has a benchmark range of the R&D spend as a percentage of revenue, and most of the enterprises used to spend in a similar range. But now enterprises are facing disruptions from many directions, which will require them to spend a lot more on R&D. Take the example of the automotive sector, which has been facing the biggest disruption in the last 100 years on four fronts connected, autonomous, shared, and electric (CASE). Auto firms have to generate more output from R&D if they want to be on top of these trends without R&D budgets being increased. In some cases, R&D budgets are even being decreased because of the decrease in revenue for many firms either due to this pandemic or due to other industry-specific challenges such as chip shortage. So if enterprises need to accomplish more in R&D with a reduced budget, offshoring makes an attractive proposition.

Are there any other proof points supporting the above reasoning?

I can think of one. When any market becomes attractive, new players enter the space aggressively. This is happening in engineering services with scaled engineering entry of Global IT and BPO MNCs with acquisitions. With a near-zero share a few years back, MNCs now have 20% of the market share. (Read here)

Bottom line: Now, engineering services is not a demand problem but a supply problem. And a few things can go wrong here on the supply-side with attrition, and new skill sets availability, etc. Service providers that are able to overcome supply-side challenges will change the slope of their growth curve. I hope a few quarters down the line, we can decisively see the change in slope of the growth curve of the overall Indian engineering services sector. Onwards and upwards!