Is engineering services an attractive market to invest in? This is the most frequent question asked by investors before narrowing down on firms to invest in.

The next part of the question often is service provider segments and profit pool and how it will change over time. In one of the discussions, I drew a chart out of the blue on a borrowed paper (before Covid when physical meetings were allowed), which I updated recently when someone asked me a similar question.

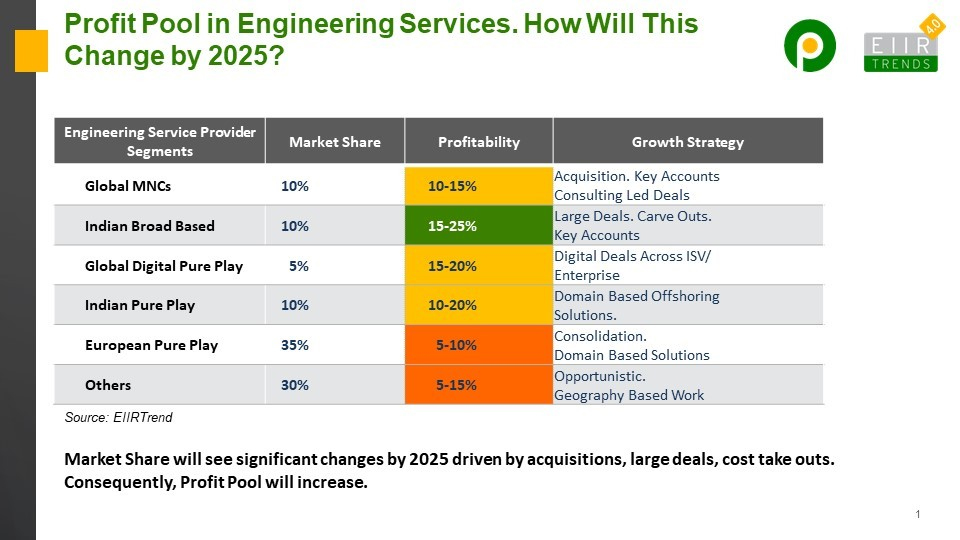

There are six distinct service provider segments, each having a different share of the pie, profitability, and growth strategy or drivers, as shown in the below exhibit.

The interesting part is not the state today but where the puck will be going to be in the future. That’s where there are a lot of assumptions and permutations and combinations. In short, I believe the market share and, consequently, profitability pool will change significantly in the next five years. Some segments will grow much faster than others. Four Cs which will impact are

- Client penetration. Only 5% of the engineering pie is outsourced to service providers, so there is more headroom for growth

- Consolidation. Both big and small. Some service providers will make big moves in consolidation, while others will make tuck-in acquisitions for capability augmentation or client access. There is a long tail of engineering service providers that will be get integrated into bigger service providers.

- Cost take out/ Large deals. Recent deal wins raise hope that there will be more large deals that may involve cost take out, captive consolidation, service consolidation, location consolidation. Since the base of engineering is lower than IT, few large deals can change the market mix quickly.

- Capability transformation. Some clients will accelerate their capability transformation, be it digital or cloud in the software side, Industry 4.0 on the manufacturing side, the advanced technology on the automotive or telecom side, business model transformation on the industrial side, or market acceleration on the medical device side. This might mean clients may want to work with a different set of service providers in the future.

Bottom Line: Profit Pool will increase in engineering services much faster than market growth because of change in service providers mix.