Strategy is about making choices, especially in critical and uncertain situations. Doing better is an aspiration and not a strategy. The biggest choice in front of tech companies in this critical and uncertain time of recession is what to prioritize growth or profitability.

The answer, as usual, is it depends.

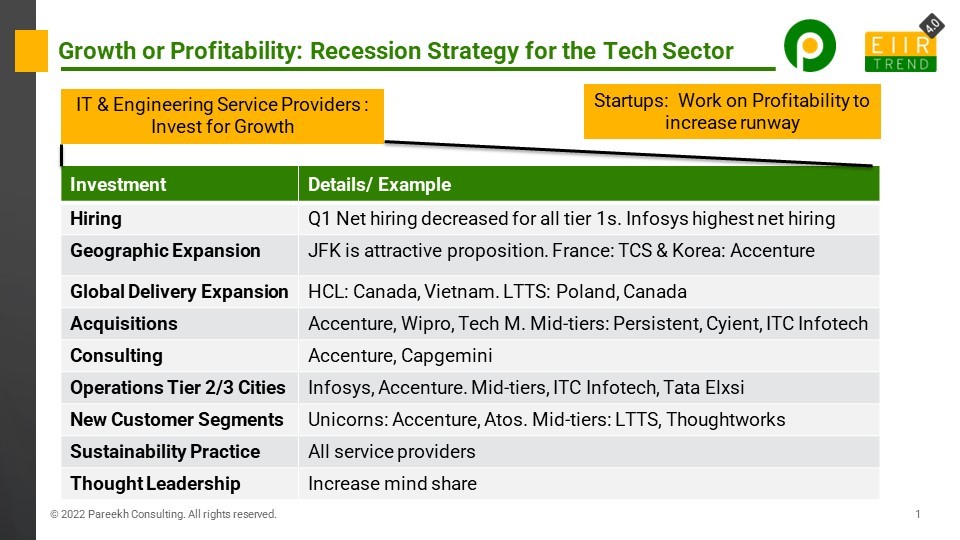

- If the firm is an unprofitable startup, it needs to prioritize profitability; otherwise, it might run out of funds for operations.

- But successful IT and engineering product or services firms, which are sitting on a pile of cash, should prioritize growth over profitability.

Why IT and engineering service providers are focusing more on profitability?

- The profitability of most of IT and engineering service providers was down this quarter because of high talent costs from great resignation and also the resumption of some of the operating costs of facilities, travel, events, etc. They want to return to their guided profitability zone.

- The impact of profitability is higher on stock prices than revenue growth.

The service providers are tightening their belts and trying many levers for higher profitability. They are aiming for higher pricing/ margin contracts and simultaneously trying to reduce the cost of operations. I have heard stories about how companies are not taking some low-margin work and demanding higher profitability in new work, keeping in mind high talent costs.

This is good to have a laser-sharp focus on high profitability and on creating shareholder value, but during a recession, if profitability is prioritized more than growth, then many service providers will lose the opportunity to gain market share and build capabilities to prepare for a demand uptick post-recession.

How can IT and engineering service providers focus on growth and build capabilities?

Service providers should focus on growth and growing their footprint and market share during the recession. The analogy which is often shared in the Indian IT circuit is the F1 race. In the F1 race, the only place a layer can overtake and improve its position is at turns. The recession is a sort of turn. To take advantage of this, service providers should accelerate their focus on investing in nine areas.

- Hiring: Service providers should not take their foot off the gas in case of hiring. The net hiring decreased significantly for most tier-1 IT service providers in this quarter. Infosys had the highest net hiring this quarter. Apart from hiring, they need to look for retention. Identifying, recruiting, training, and retaining talent will be a competitive advantage this decade. (Read our blog here)

- Geographic Expansion: Service providers need to increase their footprint beyond English-speaking countries, and a recession could be a good time. Japan, France, and Korea (JFK) is a $50 Billion opportunity for service providers. (Read our JFK analysis here). Recently TCS and Accenture have made moves to increase their footprints in France and South Korea, respectively.

- Global Delivery Expansion: Service providers, especially mid-tiers, need to increase their global delivery presence in nearshore countries. Recently LTTS opened delivery centers in Poland and Canada. Among tier-1 service providers, HCL opened centers in Vietnam and Canada.

- Acquisitions: A recession is a good opportunity to buy companies for customer or geographic access and build capabilities in different industries and services. Among tier-1 service providers, Accenture, Wipro, and Tech M are active in acquisitions. Among mid-tiers, Cyient, Persistent, and ITC Infotech are recently active in acquisitions. Last year top 7 engineering service providers active in acquisitions were (Read here).

- Consulting: Business consulting has been the Achilles heel for Indian IT service providers. If we look at the results of Accenture and Capgemini, their consulting business is growing faster than outsourcing. It’s time for Indian service providers to do something at scale here.

- Operating Model and Tier 2/ 3 cities: In the remote or hybrid work model during the pandemic, many employees have moved to their home towns and are reluctant to come back to big cities. To capture this talent, service providers need to have a wider footprint in tier 2/ 3 cities in India. It will help them in managing future talent requirements also by hedging their location bets in the war of talent and also the talent for future requirements. Recently Infosys and Accenture have been active in expanding their footprint in tier 2/ 3 cities. Among mid-tiers, ITC Infotech and Tata Elxsi are active in this area. There are 27 tier2/3 cities service providers can look at. (Read our research on tier2/3 cities here)

- New customer segments: Service providers should look for new and emerging customer segments, which will be crucial for growth in the future. Providing services to startups and unicorns is one such promising sector. Accenture and Atos are among tier-1 firms that are active in this space. Among mid-tiers, LTTS and Thoughtworks are active here. (Read our blog here)

- Sustainability: All service providers are building their sustainability practices. It’s time to invest further and scale up. (Read our blog here)

- Thought Leadership: The recession is the best time for service providers to raise awareness and build or increase mind share among customers as many competitors will be cutting down expenses in this area.

Bottom Line: As Warren Buffet said, “Be Fearful When Others Are Greedy and Greedy When Others Are Fearful.” This time many service providers are fearful of recession, and it’s time for forward-looking service providers to be greedy and invest in increasing footprint and building capabilities. Fortune favors the bold and one who invests and is prepared.