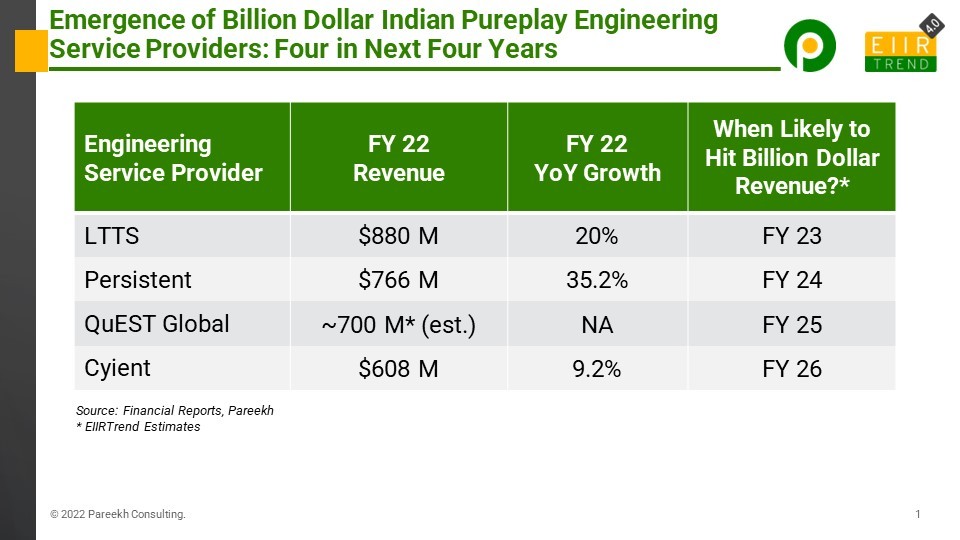

India never had any pure-play billion-dollar (by revenue) engineering service provider so far, while Europe produced many billion-dollar pure-play engineering service providers. Looks like now that drought will be over, and in the next four years, four Indian pure-play engineering service providers are likely to cross the billion-dollar revenue milestone.

The above exhibit shows the FY22 revenue of four pure-play engineering service providers, both declared and estimated, and our estimates of the time frame to hit billion dollar revenue based on their recent growth trends.

What can accelerate the time frame?

- Large Deals: It is difficult to get large deals in engineering, but if they are won, then the growth trajectory of engineering service provider changes for a year or so. In the last couple of weeks, there were a few large deal announcements, so if the trend continues, this can accelerate the time frame for reaching billion-dollar revenue.

- Acquisitions: Another driver for higher growth is acquisitions. Generally, Indian pure-play engineering service providers shy away from big acquisitions, and mostly they have been making small tuck-in acquisitions. In the last couple of weeks, there were a couple of large acquisition announcements, so if the trend continues, it can accelerate the time frame for reaching billion-dollar revenue.

What can stop this?

- Market slowdown and Black Swan events. While the long-term story and value proposition of India’s engineering services are intact, short-term disruptions will keep impacting the growth momentum. R&D is mostly discretionary spending, and in case of enterprise cash flow fluctuations, R&D spending could be impacted in the short term. We have seen some black swan events such as a pandemic, chip shortage, and Ukraine crisis in the last couple of years. So far, Indian engineering service providers have fared well in navigating them, but the risk remains for the continuing growth.

- Getting acquired: We have seen in the past that a couple of engineering service providers in $500-$800 Million which had a shot of becoming a billion firm such as Aricent, GlobalLogic chose to get acquired and part of larger Global IT MNC. Many Global IT MNCs are still scouting for pure-play engineering service providers to enter or augment their engineering services footprints (Why MNCs are acquiring engineering service providers. Read here). These service providers could be acquisition targets for Global IT MNCs.

Why is this important?

The engineering service business is very difficult to scale because of being core business of customers, small size deals, high expertise requirement, high investment in labs, capabilities, geographical footprint, etc. But now things are changing, and I believe an inflection point has been reached, and now growth will be on a higher trajectory (Read here and here)

Crossing billion-dollar revenue milestones by these engineering service providers will be proof points supporting this hypothesis. This will inspire the next lot of Indian engineering service providers to aim for this milestone aggressively and also give confidence to investors about the growth and scalability prospects of pure-play Indian engineering service providers.

What Next?

I wrote about three stages of growth of engineering service providers. And billion dollar plus companies will have to change their strategy for growth. What bought them here might not take them to the next level. (Read here). It will be interesting to watch how these pure-play Indian engineering service providers transform for the next phase of growth (post-billion-dollar milestone).

Bottom line: One thing Indian IT service providers have shown in the last four decades is adaptability and riding growth waves based on market needs and environment while overcoming all challenges. We hope pure-play Indian engineering service providers will also show similar adaptability and growth. I think a crossing of the billion-dollar milestone will be the first of many steps in their growth journey in the top league of global engineering service providers by revenue.