One growth strategy many engineering service providers are working on is targeting end customers or customers of their customers. Traditionally engineering service providers work for OEMs and tier 1 suppliers in many industries, but there are engineering opportunities with the end customer or customer of customer also.

Where are end customers spending on engineering?

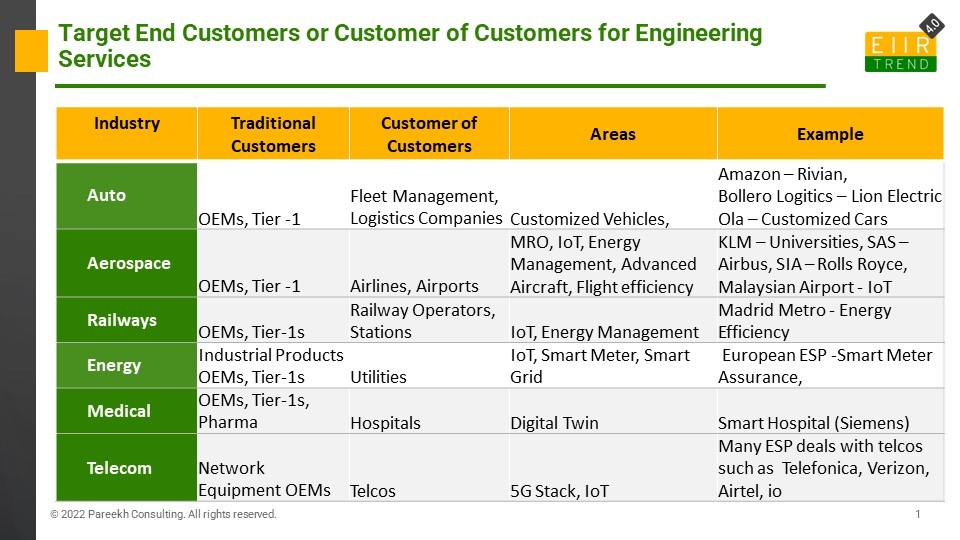

Take these six industries and their customer of customers:

- Automotive: Traditional automotive engineering services customers are OEMs and tier-1s. Their customers are fleet management and logistic companies which are investing in engineering for their customized vehicle needs and also vehicle management, predictive maintenance, and new business models.

- Aerospace: Traditional aerospace engineering service customers are OEMs and tier-1s. Their customers are airlines and airports. Airlines are investing in engineering for advanced aircrafts. MRO, flight and fuel efficiency, and sustainability. Airports are investing in IoT, energy management, automation or contactless operations, and sustainability.

- Railways: Traditional railway engineering service customers are OEMs and tier-1s. Their customers are railway operating firms and railways stations that are investing in engineering for IoT, predictive maintenance, asset management, and energy management.

- Energy: Traditional energy engineering service customers are industrial equipment OEMs and tier-1s. Their customers are utility companies and fuel retailers who are investing in IoT, smart meters, and smart grids.

- Medical: Traditional medical device engineering service customers are medical device OEMs and tier-1. Their customers are hospitals that are investing in IoT, digital twin, and telemedicine.

- Telecom: Traditional telecom engineering service customers are network equipment OEMs and tier-1s. Their customers are telecom operators. Telcos are investing in their own 5G stack and IoT.

Why are end customers spending on engineering?

Two main reasons:

- Product to Solution Stack: Enterprises across industries are moving from products to solutions, and engineering has a big role to play in it. For example, in the telecom sector, telcos are no longer providing connectivity. They are providing solutions to customers using IoT and hence the incentive for spending more on engineering.

- Digital & Customer Experience: End customers are facing competition in their industries from emerging digital native players, and to survive and thrive, they need to differentiate, embrace digital transformation and provide a better customer experience. Engineering is the foundation for digital transformation (Read here). Every enterprise is going thru digital transformation to embrace virtualization and also because of competitive pressures from digital natives. They want to spend on engineering for differentiation. For example, airports are investing in contactless technology and energy management for customer experience.

How can engineering service providers capture the end customer engineering services market?

Broad-based engineering service providers are better positioned than pure-play service providers to capture customers of the customer engineering market because of customer access due to IT and BPO relationships, but that can change if pure-play service providers can look at this segment strategically leveraging acquisitions, partnerships, solutions, etc. Take a look at how much business from the customer of customers they are getting and run a separate program with the new team to drive this segment.

Bottom Line: Engineering is the backbone of digital transformation, and its use is accelerating beyond traditional customers. Engineering service providers, both broad-based and pure-play, should build their value proposition around this and work proactively with the customer of customers in their customized needs, in their shift from products to solutions and digital transformation. This is necessary to capture the next phase of growth of engineering services.