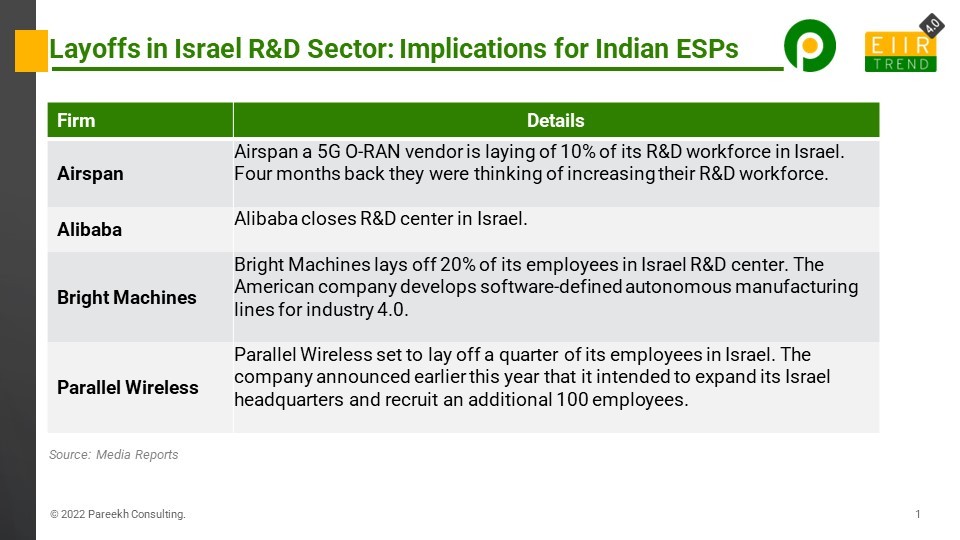

This week there were four news items about layoffs in the Israel R&D sector that caught my attention.

How are Israel R&D layoffs different than Indian R&D Layoffs?

Layoffs have been going on in India too. But in India, most layoffs are in startups catering to the domestic market. And they are mainly related to funding issues. So far, we have not come across any layoffs from MNC R&D or GCCs (Global Capability Centers).

In contrast, layoffs in Israel are from Global R&D centers.

Why are layoffs happening in Israel’s R&D sector?

Layoffs are happening because of changes in external market conditions. Companies want to be the right size to align R&D cost structure with changing conditions. There are two surprising things here

- How can the situation change in a quarter. A couple of firms that laid off mentioned a few months back about increasing the R&D headcount in Israel

- Digital and emerging areas. These layoffs are not in sunset or legacy areas. These are in emerging or digital areas such as 5G, Cloud, and Industry 4.0.

What are the implications for Indian engineering services?

It shows enterprises are under stress and trying to rationalize R&D spend and headcounts. The immediate target is headcount in high-cost countries. But what next, especially for India?

It can go two ways for Indian engineering services.

- Enterprises think of the short term and try to reduce R&D spend and headcount in India with both engineering service providers and GCCs.

- Enterprises take a medium-term approach and take this opportunity to transition more R&D offshore to reduce R&D cost/ hour.

It will depend upon enterprise to enterprise how will they respond. I don’t think all enterprises will go for the first alternative. Many companies will think medium to long term and go for the second alternative. Recessions come and go, but the competitiveness of the company will depend on R&D.

I think growth from the second group of enterprises (which will offshore more) will be more than enough to compensate short-term decline from the first group of enterprises (reduce R&D spend).

Bottom Line: It is a developing situation and cause of concern for engineering service providers. They need to watch out for their customers closely and take action accordingly. There may be opportunities also for service providers with the strong balance sheet to look for deals with financial reengineering:

- Long duration large deals which reduce enterprise R&D cost/ hour

- Buying captive R&D centers in both high-cost and emerging countries and helping customers convert fixed costs to variable costs and improve cash flow.

- Buying small service providers that have common customers to reduce financial risk for customers