Captive or global-inhouse centers (GIC) buyout is an evergreen topic in engineering services conversation. And its frequency of discussion accelerated after the start of the pandemic.

This is because engineering services globalization is dominated by captives or GICs. In India, about 55% of engineering services pie is with captives, and the rest 45% is with service providers. This is much higher than the IT and BPO case, where 10% of IT and BPO pie is in captive, and the rest 90% is with service providers.

And there are reasons for this as engineering is part of core operations for most enterprises, unlike IT and BPO, which is mostly SG&A. Enterprises who want to avail cost and talent benefit of globalization but don’t want to take the risk of third-party, preferred captives until now.

There is hope that as the engineering service provider market matures like the IT and BPO service provider market, enterprises will get more confidence in service provider capability, and more work will come to engineering service providers. In the last couple of years, engineering service providers grew faster than engineering captives.

One part of the hypothesis is that as part of this shift, many enterprises will lookout for monetizing their captives, creating opportunities for engineering service providers. And this pandemic will act catalyst to this trend, something similar to how GFC became the catalyst for IT and BPO captive buyouts in 2008.

The major hypothesis in a captive buyout is the economic viability of a subscale captive, which has less than 500 people. It makes a good economic business case for enterprises to look for exit options for these subscale captives.

After seeing trends in the last six months, engineering captive buyout has limited success. A couple of transactions were there, and then there were rebadging components in many engineering deals, but it didn’t accelerate, at least so far.

Why is this so? India vs. China

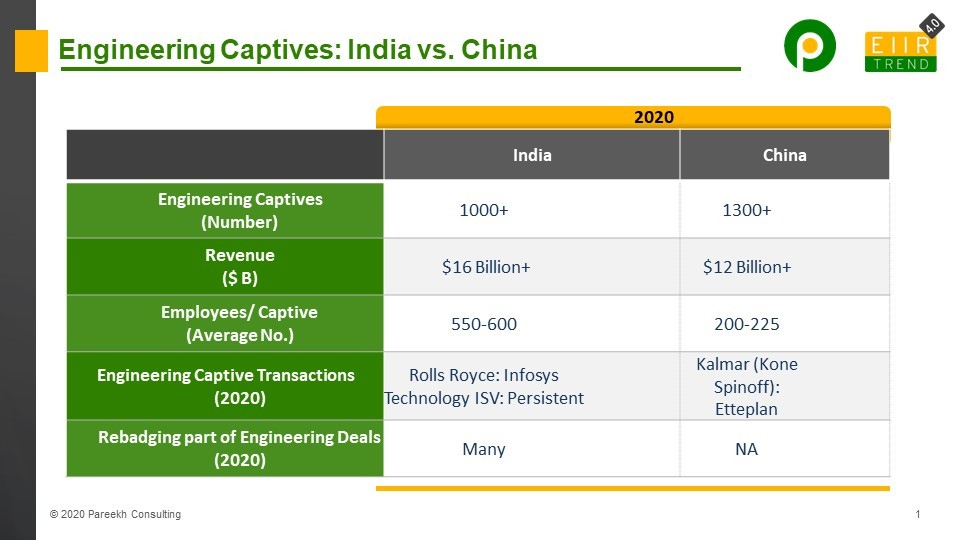

There are many reasons, but one reason is India is only one part of the equation for global enterprises. The other part of the equation is China. As China had become the manufacturing hub, and engineering is often linked to manufacturing, China had a large number of engineering captive centers, even more than India.

The interesting part is though China has more number of engineering captive centers, its overall engineering captive pie is less than that of India. And guess what? China has more number of subscale captives.

As because of geopolitics and other reasons, global enterprises are revaluating their manufacturing footprint in China. Some enterprises which are a major player in China’s domestic market are staying put and even doubling down their China investment. In contrast, enterprises that use China as a global hub might relocate some of their operations.

So there are more opportunities for engineering captive transactions in China, but Indian engineering service providers don’t have footprints in China to capitalize on this, and in this environment, this is unlikely to change. (Though there could be one or two exceptions)

What could happen to China’s engineering captives?

Three categories of buyers might benefit from this.

- European Service Providers: The biggest opportunity is for European engineering service providers, which can capitalize on it as recent captive transaction indicates.

- Rise of Asian or Chinese Pure Play Service Providers: Service providers in China are not as mature or global as in India. In engineering services, there are a couple of service providers that have the scale and global recognition, such as Pactera, Neusoft. There could be a rise of a few more service providers like them if they buy these captives. Similarly, some other service providers in China-friendly countries such as Malaysia, Singapore can buy these captives as well.

- Private Equity: Some Asia-specific PE firms which have exposure and understanding of the China market may enter this space and create regional players. Similar to what Private Equity is doing with few service providers in India and Europe.

Whatever be the case, there could be a change in the global engineering landscape. I wrote earlier that the engineering service market is dominated by Indian and European engineering service providers, and now global MNCs are entering it. ( https://pareekh.com/global-mega-service-providers-are-investing-in-engineering/)

This could mean the increase in global strength of some of European engineering service providers or the rise of Asian (Non-Indian) service providers as well

Bottom Line: Engineering captive buyout opportunity might playout differently in China. We need to keep track of Chinese captive monetization trends and the emergence of a changing landscape.