Recently Denso reorganized its North America engineering and R&D divisions. The five product groups were ditched, and R&D was reorganized into three horizontal or functional areas. The reason is to better integrate the company’s R&D capabilities and to enable teams to work more cohesively, enhancing integration, performance, and quality. (Read here)

And Denso is not alone. There are many organizations that are partially moving away from product-based R&D silos to functional-based R&D structures.

For example, Sony last year established a new consumer electronics unit integrating many business and product lines. All product and R&D platforms are aligned with the new entity. The reason is simplification and enhancing its competitiveness. (Read here)

Another example is the recent moves by Automotive firms, both OEMs and Tier-1s, to consolidate software activities from different product groups and into one separate organization. Previously, software functions were spread across the business functions of the auto enterprises, so there were several local-level decisions for in-house development and outsourcing roadmap. But given the technology complexity (development, integration, etc.) in a vehicle, auto enterprises are looking for a centralized software business unit that can look into the entire stack for overall innovation rather than a partial view by the existing silos across the business functions. (Read here)

Business Unit (BU) level or product level R&D units can be combined fully or partially to move towards Functional R&D structure as shown in the below exhibit.

Why are enterprises moving towards a Functional R&D structure?

In three words: Inspired by Apple.

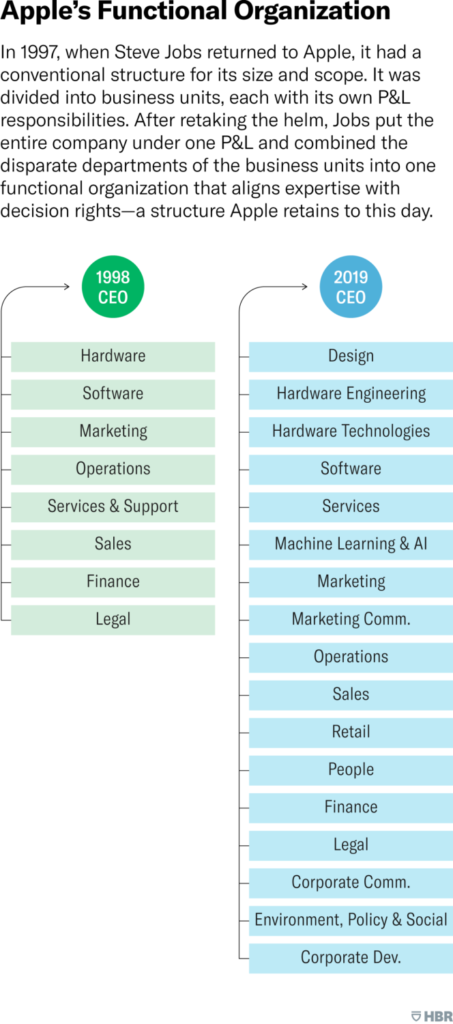

Apple doesn’t have a business unit or product unit structure or P&L It has a Functional R&D structure with hardware, technology, software design, AI, among others, as functions. Functional R&D structure is preferred for innovation, expertise with deep specialization, continuous improvement, a collaboration which is reflected across many products.

Source: HBR (Read here)

Implications for R&D Organizations: Accountability vs. Innovation

Product level or Business Unit level R&D structure works well in mature enterprises where accountability is more important. Each product line has the freedom and is responsible for its R&D and accountable for outcomes. There is more focus on budget and timelines rather than working on longshots.

Where innovation is more important, Functional R&D structure might work better because:

- Scale in functions helps develop functional capabilities better.

- More freedom for R&D organizations to pursue longshots and crack harder problems without worrying too much about product-level P&L

- Removal of silos, increase in collaboration, and avoidance of shadow R&D or duplication of efforts in different product lines.

- More focus on new technologies and innovations whose use cuts across products and business lines.

- Career path for functional experts and a better chance of retaining them and engaging them in doing cutting-edge work in their fields of interest.

Functional R&D structure worked well for Apple as innovation is critical in the industry in which it is operating. More hi-tech companies are inclined to try Functional R&D structures. Another industry that is facing large disruption is automotive, and they are taking baby steps for Functional R&D structure by consolidating software as a separate function.

Now with the advent of software, IoT, AI and other technologies, every product in almost all industries has become smarter. Enterprises that will survive disruption and win in their markets will rely more on innovation. Hence more enterprises in more industries are likely to follow the Functional R&D structure.

Implications for engineering service providers

For engineering service providers, this is an opportunity. The biggest challenge in engineering service is the size of deals. Because of Product or BU level R&D, the size of deals is smaller, and there are many stakeholders.

Now with scaled Functional R&D structure and centralized decision making, there is a possibility of larger engineering services deal size. Opportunities will be for service providers who show deep capability in different R&D functions. Engineering service providers should start to rethink the transactional nature of their relationships with some of the enterprises. For becoming strategic partners, service providers need to go for specialization aligning themselves both in terms of capability and relationship with enterprises.

Bottom Line: As more enterprises shift from accountability to innovation, there will be more adoption of Functional R&D structures, and it is good news for both R&D professionals and engineering service providers.