One theme emerged during this quarter’s earnings calls of Indian engineering service providers: revenue growth vs. volume growth.

One engineering service provider mentioned that its revenue growth is about 20% this year, but volume growth is 28%. Another service provider had negative revenue growth in one of the verticals but had a positive volume growth.

Why do we mean by volume growth?

It is growth in the number of billable man-hours or billable man/months. So if volume growth is more than revenue growth, then Revenue/ FTE( Billable) is coming down. This could happen due to two main reasons

- Decrease in pricing

- Increase in offshoring

Thankfully it is the latter in the case of Indian engineering service providers. Pricing is not coming down, and in fact, it is even increasing in a few areas. The increase in offshoring is causing Rev/FTE (Billable) to come down. (Revenue/FTE can also come down because of the higher number of trainees or less utilization percentage, but here we are talking about Revenue/ Billable FTE excluding utilization and trainee impact). An earlier offshore: onshore ratio of about 70-75 %: 25:20% is coming down to 80-90%: 20-10% in many engagements.

Why is there an increase in offshoring?

This is happening across IT, BPO, and engineering services, but it has significant implications for engineering services. Engineering is core work for enterprises, and there were a lot of assumptions that it can’t be outsourced, and even if outsourced, it can’t be offshored at scale. That’s the reason European service providers have a larger share because of their onshore presence. But this pandemic forced enterprises to relook at these assumptions. Most work is being done virtually, so location constraint is not as big as was once believed. This is driving enterprises to rethink their engineering operating model, and there is no better place than India, which can provide engineering talent at scale and at the right price points. So offshoring is increasing.

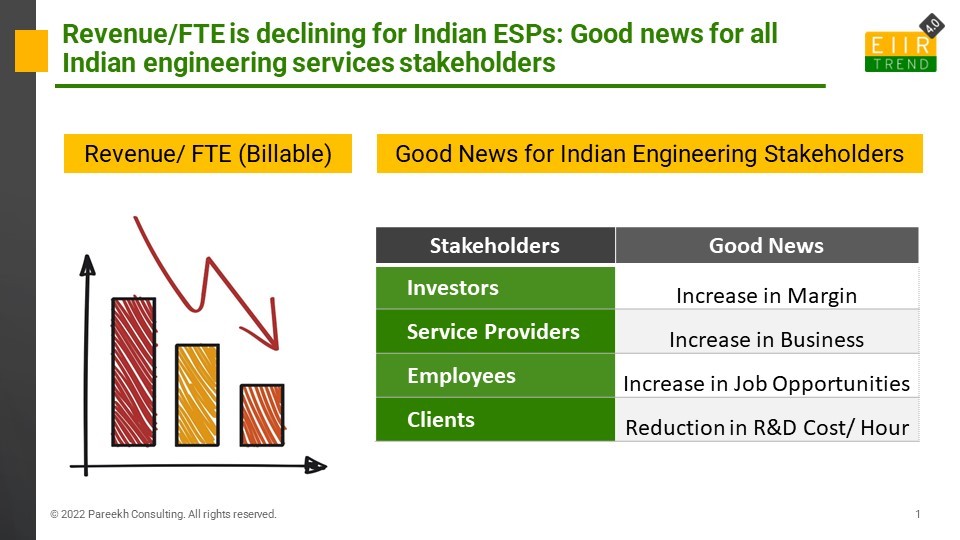

Why is it good news for all Indian engineering services stakeholders?

- Investors: Good for margin. Offshore outsourcing has a higher margin than onshore outsourcing. The rise in margin drives enterprise value and stocks up.

- Engineering Service Providers: Increase in business. The rise in offshoring will lead to an increase in business for Indian engineering service providers in the medium term. The cost was never a dominant reason for engineering outsourcing, but that is changing now. Enterprises exist because of their competitive edge in developing products, and for strategic reasons, they don’t cut costs here as much as they are willing to do in support functions. Every industry has a benchmark range of the R&D spend as a percentage of revenue, and most of the enterprises used to spend in a similar range. But now, enterprises are facing disruptions from many directions, which will require them to spend a lot more on R&D. Take the example of the automotive sector, which has been facing the biggest disruption in the last 100 years on four fronts connected, autonomous, shared, and electric (CASE). Auto firms have to generate more output from R&D if they want to be on top of these trends without R&D budgets being increased. In some cases, R&D budgets are even being decreased because of the decrease in revenue for many firms, either due to this pandemic or due to other industry-specific challenges such as chip shortage. So if enterprises need to accomplish more in R&D with a reduced budget, offshoring makes an attractive proposition.

- Employees: Increase in jobs. Volume increase in offshoring will create more job opportunities for employees. This is already started happening with the rise in job opportunities without an increase in supply is creating great resignation and atrocious attrition. This will normalize with more highering of freshers. In the medium term, this will create more job opportunities, and engineering service providers will look for innovative ways to identify, recruit, train, and retain engineering talent.

- Clients: Reduction in R&D Cost Per Hour. As discussed earlier, the cost was never a dominant reason for engineering outsourcing, but that is changing now. And more offshoring provides opportunities for clients to reduce their R&D Cost/ Hour.

Bottom line: The decline in Revenue/FTE because of the increase in offshoring is good news for all Indian engineering service stakeholders. This is an opportunity for engineering service providers to change the slope of their growth curve. There may be short-term challenges in managing the revenue decline because of the shift in offshore outsourcing from onshore outsourcing in some pockets if the volume growth doesn’t outpace revenue decline. Most engineering service providers have managed the transition well. This is one good sign among many, which create optimism that better days are ahead for Indian engineering services.