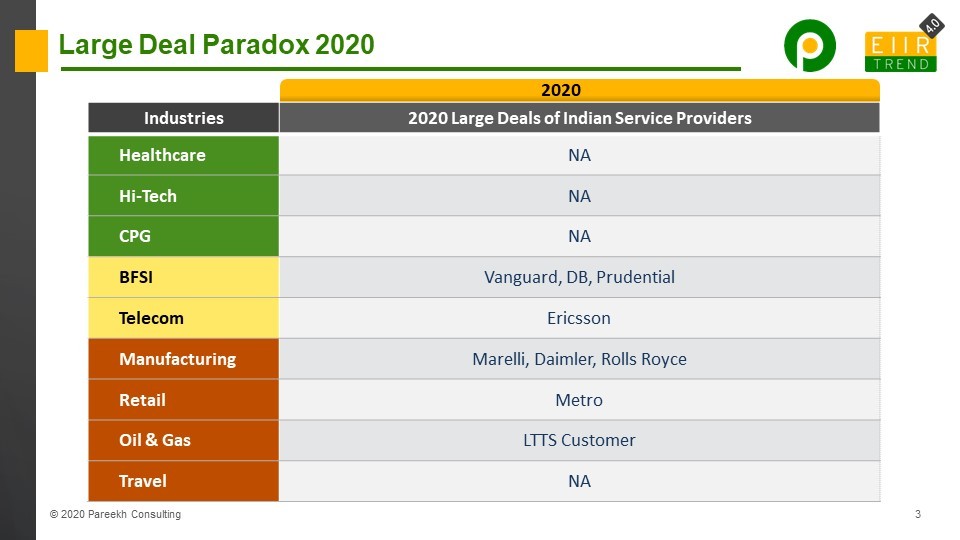

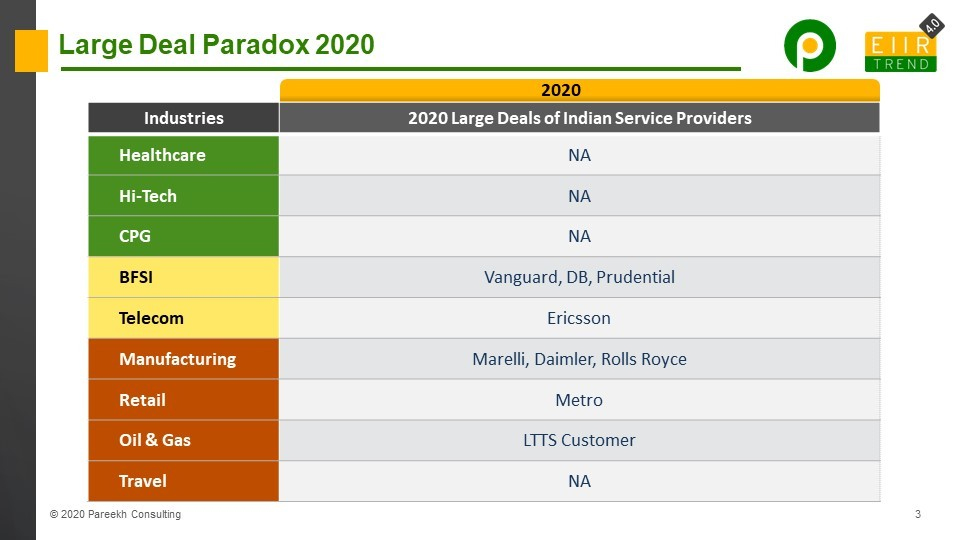

Two large deals in a single day just a couple of days before Christmas shifted the focus on large deals while signing off this year. While looking at publicly declared large deals (TCV $100 Million+) won by Indian service providers, I noticed a pattern. None of the deals are from industries that are doing well in the pandemic, such as healthcare, hi-tech, CPG. Almost all large deals (at least in the public domain) which I came across are from industries that are either not doing well or performing normally.

There could be a possibility that some large deals are signed in growing industries but not in the public domain, or some deals might be in the pipeline. Still, this is an interesting point to reflect on

Why is this happening? Three drivers of large deals now

· Digital or Cloud

· Cost take out from customer’s operations while optimizing their cost base.

· M&A-led consolidation of IT functions and centers

While digital is a driver across industries, the need for cost take out, and M&A led consolidation is more in trouble industries than industries doing well.

Overall, client budgets are not increasing, but few tier-1 and selected tier-2 vendors are getting the benefit of vendor consolidation and also becoming beneficiaries of the realignment of work between captives and service providers.

In large cost take out programs, everything is on the table, including vendor consolidation, captive consolidation, location consolidation, and service consolidation. It may mean that work going to other vendors and internal teams, including captives, will come to selected service providers. And sometimes, it will require rebadging and taking client resources on the roll. The whole logic of clients giving these resources to service providers is that they don’t feel these resources will be required in the same volume in the coming years. Here large service providers that have the scale and geographical footprint are having an advantage as they can take these resources in any geography and later can use them in projects for other clients also when volume requirement goes down.

Because of the profit cushion service providers are having now because of remote work and travel restrictions, they can afford to be more aggressive on these large deals without sacrificing their target margin range.

Bottom Line: The paradox of large deals will continue in 2021, and we will see more deals in industries where there is more pressure for cost take out.