We recently released our Enterprise Buyer’s Guide for MES Service Providers.

https://eiirtrend.com/static/enterprise-buyers-guide-2021-mes-service-provider/index.html

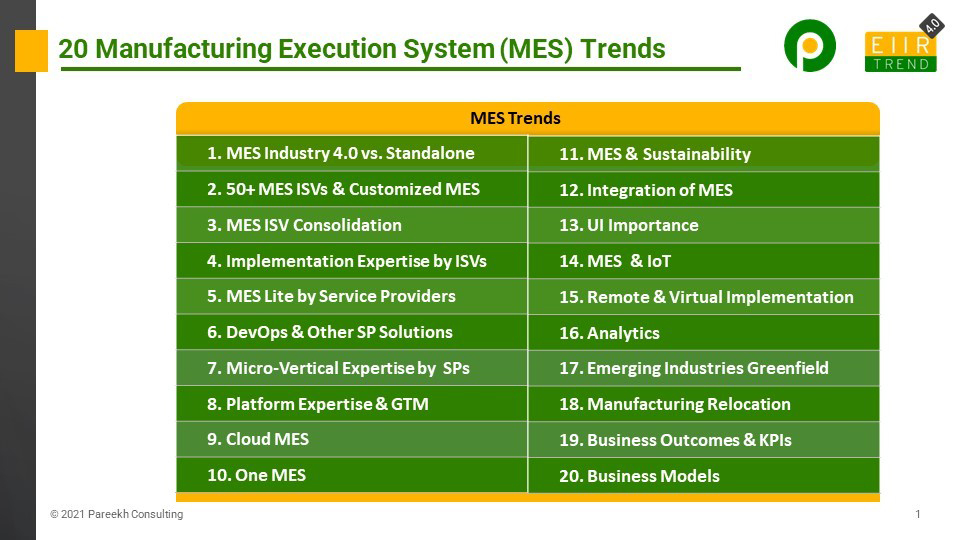

We identified a few trends/ observations shaping the manufacturing execution system (MES) service provider market by scanning the landscape and talking to stakeholders.

Trends

- Most service providers position MES as part of comprehensive Industry 4.0 offerings, while some customers make MES decisions separately.

- MES software market is a diverse landscape of 50+ MES ISVs. MES service providers find it challenging to manage expertise and relationship with all MES ISVs. The interesting trend is that despite having so many MES software options available, many enterprises still prefer their own customized MES.

- Consolidation of the MES software market is a good possibility, and the recent Rockwell acquisition of Plex and earlier Dassault acquisition of IQMS are good indicators. Simultaneously emergence of new MES ISVs is also taking place.

- MES ISVs are augmenting their internal implementation team. Rockwell acquired MESTECH a couple of years back.

- Most MES service providers have developed MES Lite versions that work with different MES software to reduce initial cost and time to value for both SMBs and big enterprises.

- Service providers are reducing time to value with DevOps & other solutions, templates, and accelerators.

- Service providers are trying to differentiate themselves by developing expertise in industry verticals and micro verticals for MES implementation

- Service providers are augmenting their partnership with MES ISVs developing strong platform expertise, and developing GTM programs with MES ISVs

- Service providers are taking baby steps along with customers and ISVs in MES Cloud

- Enterprises are doing multi factory MES implementation with the vision of consolidating towards One MES. The years of M&A and local MES decisions have created a heterogeneous tech environment. Time is of the essence here in consolidating all this, and service providers are helping enterprises with innovative consolidation approaches. Here many enterprises are taking a geography-centric approach for MES consolidation.

- Sustainability has started entering MES conversations. How can MES help in enterprise sustainability initiatives?

- Integration of MES with different enterprise applications such as ERP, PLM, SCM, Planning & Scheduling App, Warehouse Management Asset Management, Simulation, and hardware such as devices and machines is becoming a critical need for enterprises. Many enterprises often look for service providers who can handle all these integrations.

- Enterprises are placing importance on the user interface (UI) of MES software for increasing MES adoption and expecting service providers to help them.

- Enterprise wants to include both MES and IoT in their Industry 4.0 roadmap. They want to understand the convergence between MES and IoT and its implications for their tech stack.

- In the pandemic, the need for remote and virtual implementation appeared, and service providers stepped up and developed these capabilities, including virtually connecting with machines.

- Analytics is essential to get value out of MES. There are different levels of analytic functionality available with different MES software. MES service providers are investing in analytics solutions and capabilities to create value for enterprises.

- Greenfield factories in emerging areas such as EV, construction, etc., are adopting MES early.

- There is manufacturing realignment because of geopolitics, localization, and other reasons. Some plants are getting closed, some new ones are opened, and the product mix is changed in many plants. This is driving the need for MES

- All service providers are striving to deliver both tangible and intangible MES-related business outcomes to enterprises.

- Different business models are emerging, and enterprises are exploring options with some service providers in reducing Capex and making it Opex or pay as you go or usage-based business models.

Bottom Line: Enterprises now realize that MES is critical for digitalization and Industry 4.0. There are changes in MES across technology, business outcomes, business models driven by both industry maturity and external events. Service providers, along with ISVs and enterprise need to develop MES strategy which delivers business outcomes and also put the enterprise on the roadmap to Industry 4.0.