One dominant theme in my discussions with engineering services stakeholders this week is the upcoming recession, bear market, and growth prospects of Indian engineering service providers.

Recession looks a real possibility with so many indicators across the world: high inflation, commodity bubble, housing bubble, funding squeeze, startups layoffs on the back of war, food crisis, supply chain woes, and also pandemic is still not over.

A bear market is a strong possibility the way the stock market has behaved in the last couple of weeks for IT and engineering services stocks. The impact is more for some pureplay and mid-tier stocks. In hindsight, all investors say that the bubble was unsustainable when some engineering stocks were trading with more than 100 P/E, but no one can predict the timing.

What could be the impact on Indian engineering service providers?

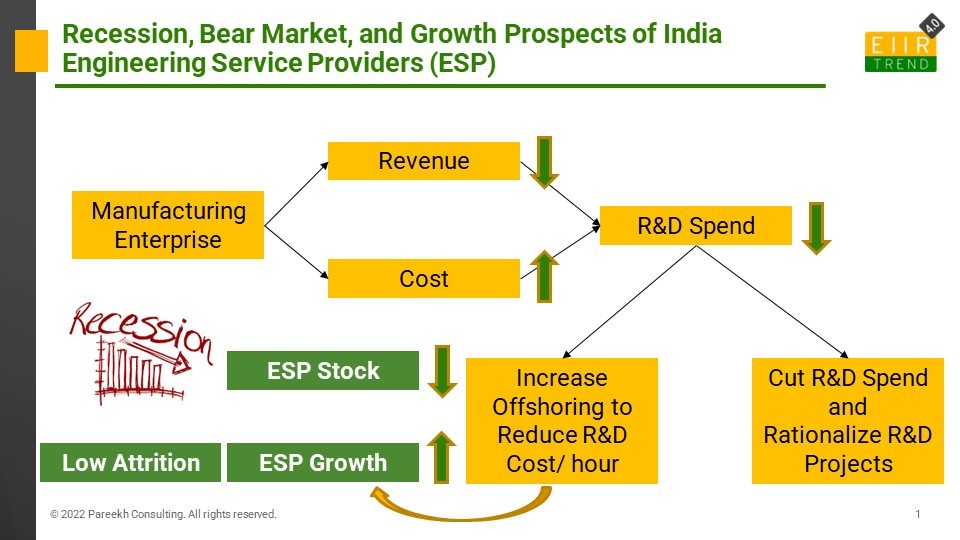

To analyze the impact on Indian engineering service providers, first, let us understand the impact on clients. Take a most common client persona of any engineering service provider, a manufacturing enterprise.

A manufacturing enterprise will face the double whammy of both the decline in demand and the increase in cost. The decline in demand will be due to retail inflation, where end customers will buy less. The increase in cost will be due to the increase in material costs because of the commodity boom and supply chain disruption. So, overall profitability for a manufacturing enterprise is likely to suffer in the short term.

In this scenario, manufacturing firms will like to control their R&D spending. They can respond in two ways regarding their R&D spending.

- Either cut R&D for short term

- Or take a medium-term approach and transition more R&D offshore to reduce R&D cost/ hour

It will depend upon enterprise to enterprise how will they respond. I don’t think all companies will go for the first alternative. Many companies will think medium to long term and go for the second alternative. Recessions come and go, but the competitiveness of the company will depend on R&D.

I think growth from the second group of enterprises (which will offshore more) will be more than enough to compensate short-term decline from the first group of enterprises (reduce R&D spend).

There is another positive second-order impact in this situation. The biggest problem for engineering service providers is attrition now, and almost all engineering service providers claimed that they would have grown higher if high attrition was not there.

The biggest reason for attrition in India is the startup boom and crazy salary hikes these startups were offering to hire talent. They were in the race to scale faster on VC money. Now new funding will rationalize, and startups will be less aggressive in hiring with high salaries. This, along with other measures adopted by the industry, will bring down the attrition for all in the tech sector, including engineering service providers.

If any business continues to have good demand and now more available supply, that business is bound to grow.

But what about the stock market prospects of Indian engineering service providers?

There could be a dichotomy between revenue growth and stock price growth. Remember in the second half of FY 21 when revenue was declining for many service providers, but stocks started rising on high optimism.

This time again, there could be a dichotomy but in the opposite direction. The revenue will rise, but stocks may come down for Indian engineering service providers on bearish sentiments.

Bottom Line: Concerns of recession and bear market are real. It will all depend upon how clients react, and if more clients think of the medium term, we might see continued growth in Indian engineering services. The stock market is another case. In the medium term, the stock market will adjust to the industry and company’s growth prospects, but in the short term, it is driven by sentiments. It will be a good buy opportunity for a few quality engineering services stocks.